Odoo and the Anglo-Saxon Accounting

Odoo was originally designed with a "European/Continental" flavour, so it supported the Continental (Rhine) Accounting principles. The main difference between the Continental accounting and the Anglo-Saxon accounting (used in Australia, New Zealand, etc.) is in the way inventory is treated when it is received or delivered. In a nutshell, we report it as "Cost of Goods Sold" whereas the Europeans expense it.

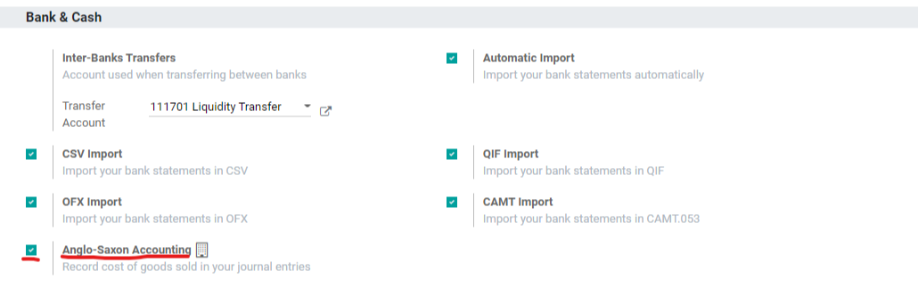

Luckily, Odoo supports both models and it is a simple task of ticking or unticking the "Anglo-Saxon Accounting" in the Accounting configuration (need to be in developer mode).

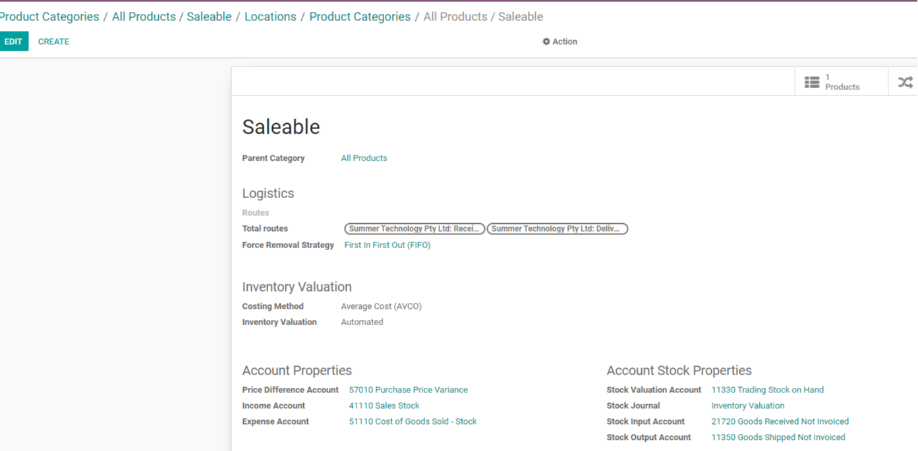

Accounting-wise, the "Received not invoiced" and "Shipped not invoiced" belong to the balance sheets accounts, as they are a liability and assets (waiting to be realised when the Invoices are produced).

Configuring Odoo as per the two screenshots above, will result in cost of goods sold being recognised when products are sold/delivered. In a Nutshell, the Anglo-Saxon Accounting (U.S. , U.K., Australia, New Zealand, etc.) in Odoo This will result in costs and revenues being taken into account at the same time.

Note : The Anglo-Saxon switch is not available in the Community Edition of Odoo (but can be switched on by experienced Odoo Implementers).